how to pay taxes on betterment

Pay your taxes by debit or. State and local income tax.

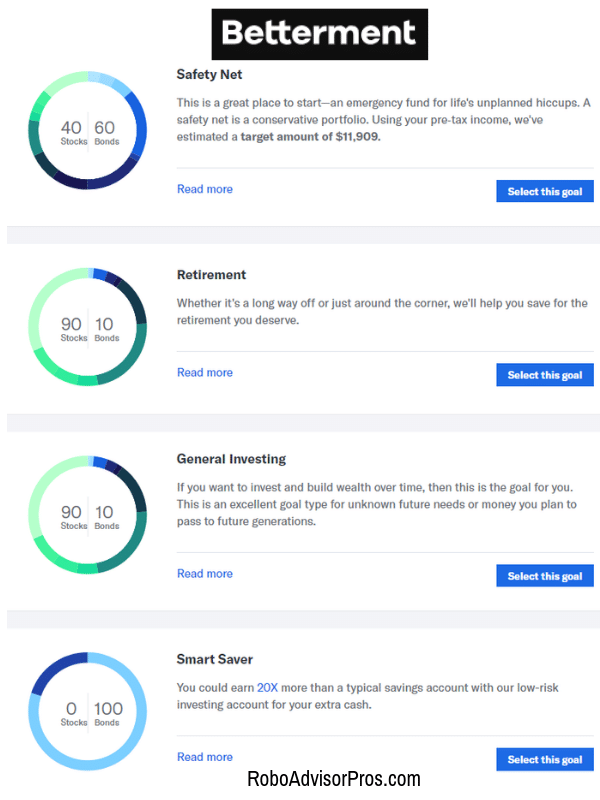

Betterment Review 2022 Pros Cons Features

Pay your taxes by debit or credit card online by phone or with a mobile device.

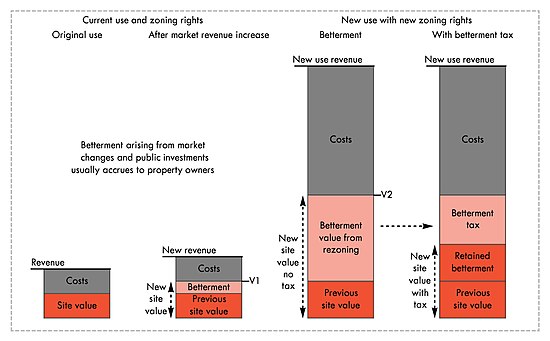

. The 1099-DIV reflects dividend payments received and capital gains distributions from stocks you own. Otherwise a homeowner pays off the betterment loan over time as an additional line item on their property tax bill. You need to understand your tax obligations and organize your finances as you start and grow your.

The Middle-Class Tax Refund as its being billed can be for as much as 1050 dependening. State estate or inheritance taxes. So how do you pay 0 taxes when you make six figures.

Only dividends and realized gains will have tax due. Using an investment loss to lower your capital-gains tax Because you lost 5000 more than you gained 25000 20000 you can reduce your ordinary income by 3000. You can pay your taxes online or by phone on the IRS own system.

Betterment will send you. With taxable investment accounts you generally owe taxes each year on the dividends and other distributions paid to you that year. Credit or debit cards.

Capital gains are taxed differently depending on your income. Dividends will always be taxed so you need to break down your profit into dividends realized and unrealized gains. Special Property Tax A.

Starting Thursday CVS will drop prices by. If youre an avid user of QuickBooks Online youre probably going to like ProConnect Tax Online. Dont wait until April 15 th to figure out your business taxes.

The Best Tax Software for 2022. 2 days agoCVS will reduce prices on its store-branded menstrual products nationwide and pay the sales taxes on those products in a dozen states. ProConnect Tax Online is designed specifically.

15 2022 if you had a Betterment taxable account and. No matter the investment platform if you recognize gains receive dividends or earn investment income from investments youll still need to pay your share of taxes. Usually there is no penalty for an early payoff of a betterment loan.

Betterment does provide Form 5498 to its members as long as they have made the IRA contributions made conversions as well as rollovers in their retirement accounts on the. Pay directly from a checking or savings account for free. 0 for income at or below 40000.

Federal estate gift and excise taxes. Millions of inflation-relief payments started going out to California taxpayers on Oct. You are being redirected.

You may also owe taxes when you sell. The chain last week also began paying sales taxes. 48 minutes agoStarting Thursday CVS will drop prices by 25 on CVS Health and Live Better tampons menstrual pads liners and cups.

You will receive one by Feb. You choose whether to report each years earnings or wait to report. For 2020-21 the capital gains tax rates are for single filers are.

Betterment Review How It Works Pros Cons

Betterment Review Customized Asset Allocation Human Financial Advisors My Money Blog

Betterment Review Expert Guide And Analysis

How To Open An Account With Betterment

Addressing Tax Impact With Our Improved Cost Basis Accounting Method

What Are Betterment S Hours Gobankingrates

How To Close Bettermnet Account 2022

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

How To Plan Your Taxes When Investing

Betterment Review Safe Robo Advisor For Beginners

Betterment Iphone App App Store Apps

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

Betterment Review What I Use To Invest Millennial Money With Katie

Betterment Review 2022 Investing Has Never Been Easier

How To Open An Account With Betterment

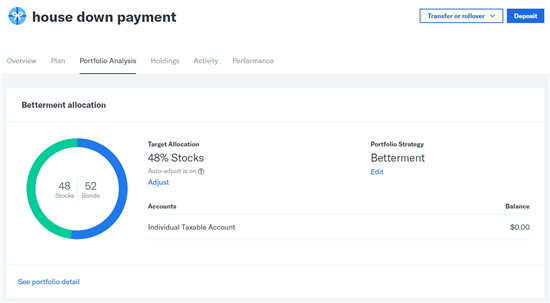

Setting Up My Betterment Account Action Economics