irs child tax credit customer service

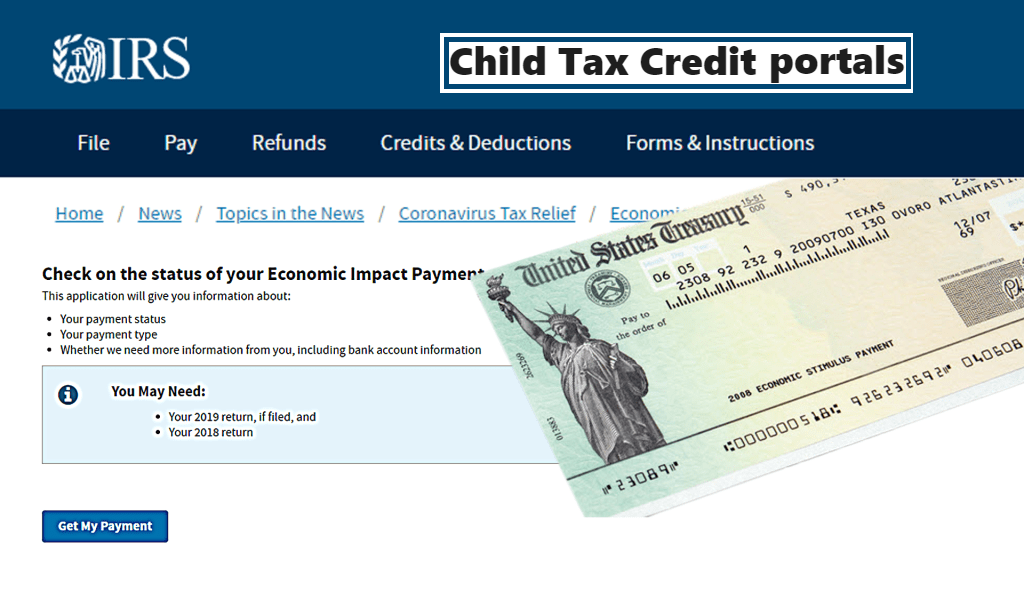

Missing child tax credit payments. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code.

Irs Sent 1 1 Billion In Child Welfare Payments To The Wrong People

Try one of these numbers if any of them makes sense for your.

. Reconciling your Advance Child Tax Credit Payments on your 2021 Tax Return on the IRS website. The Internal Revenue Service erroneously sent more than 1 billion in child tax credit payments last year to millions of Americans who werent eligible for the free cash an. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

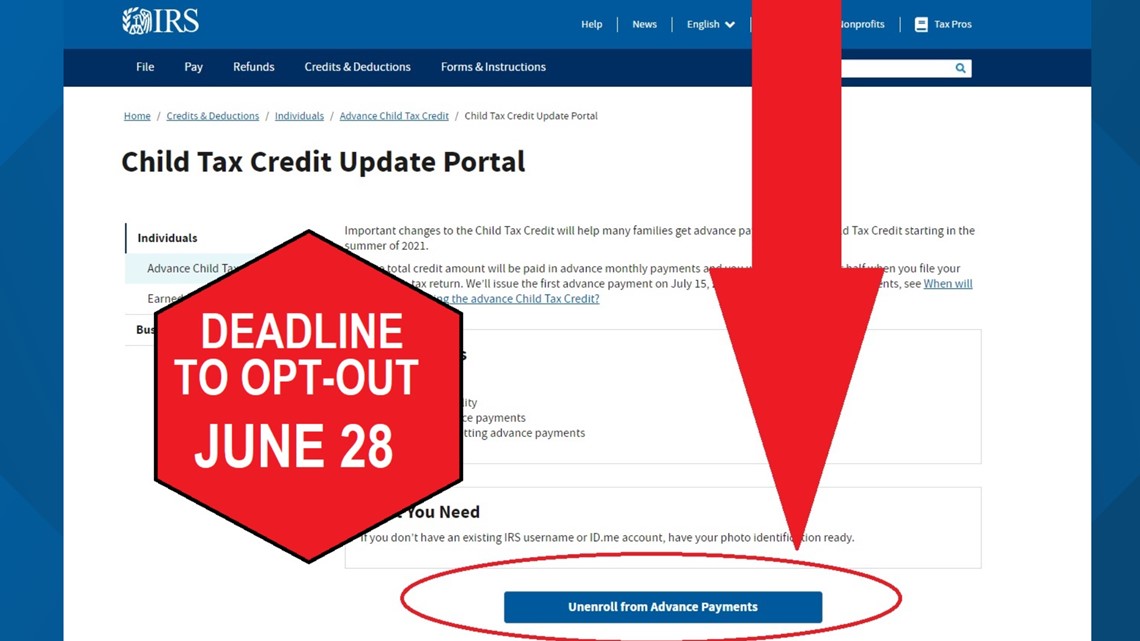

The advance payments of the Child Tax Credit are well underway with the third payment to be deposited Sept. 52 rows IRS Phone Number. The Internal Revenue Service is keeping its Free File program open an extra month which extends the time for eligible people to claim COVID stimulus payments including the.

The IRS maintains a range of other phone numbers for departments and services that deal with specific issues. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Credit for the Elderly or the.

For more details see Topic H. Estate and gift tax questions. The child tax credit program which was expanded during the pandemic helped tens of millions of kids and their families and contributed to a 46 decline in child poverty.

Learn more about this topic. 15 but the millions of payments the IRS has sent out have not. The IRS pre-paid half the total credit amount in monthly payments from.

Yes you may claim the child tax credit CTCadditional child tax credit ACTCrefundable child tax credit RCTCnonrefundable child tax credit. Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. The Child Tax Credit changes for 2021 include lower income.

Customer Service and Human Help Options. You can see your advance payments total in. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

Before 2021 the credit was worth up to 2000 per eligible child and 17-year-olds were not eligible for the credit. It is a tax law resource that takes you through a series of questions and provides you with responses. Many families received advance payments of the Child Tax Credit in 2021.

For all other tax law inquiries visit the Interactive Tax Assistant on irsgov. The Child Tax Credit Update Portal is no longer available. The child tax credit is 2000 for.

Child and Dependent Care Credit Flexible Benefit Plans. Find answers about advance payments of the 2021 Child Tax Credit. Have been a US.

Choose the location nearest to you and select Make Appointment. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Make sure you have the following information.

These updated FAQs were released to the public in Fact Sheet 2022-32PDF July 14 2022. Frequently Asked Question Subcategories for Childcare Credit Other Credits. The IRS skipped about 37 billion in advance child tax credit payments for 41 million eligible households but sent more than 11 billion to 15 million filers.

Child Tax Credit for 2022. Back to Frequently Asked Questions.

Irs Tool Helps Low Income Families Register For Monthly Child Tax Credit Payments Tax Pro Center Intuit

Child Tax Credit Irs Unveils Address Change Feature For September Payment

Irs Child Tax Credit Tool Opens For Low Income Americans 13newsnow Com

2021 Advanced Child Tax Credit What It Means For Your Family

Irs Adds Address Change Capability To Child Tax Credit Portal Nstp

Advance Child Tax Credit Payments From Irs Might Not Be Available For Parents Of Kids Who Were Born In 2021

Irs Cp 08 Potential Child Tax Credit Refund

Should I Opt Of Child Tax Credit In 2021 11alive Com

Child Tax Credit 2022 You Might Have Received An Incorrect 6419 Letter Irs Warns Lee Daily

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Irs Beware Of Scammers Trying To Cash In On Child Tax Credit Payments

Irs Adds Address Change Capability To Child Tax Credit Portal Where S My Refund Tax News Information

Gobank Advance Child Tax Credit Payments Update Expecting A Child Tax Credit Payment Customers With Their Gobank Account Information On File With The Irs From Their 2020 Tax Filing Will Automatically

/cloudfront-us-east-1.images.arcpublishing.com/gray/L6QOIUO7NRFJ3ENZ4A52GTLCKU.bmp)

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

Tools To Unenroll Add Children Check Eligibility Child Tax Credit

Child Tax Credit What We Do Community Advocates

What To Do If You Got An Incorrect Child Tax Credit Letter From The Irs